General Overview

The year 2007 was a fine year for us at Borusan. Although the markets were sending plenty of worrying signals and economic troubles seemed to be looming on the horizon, we maintained our robust growth last year. Our success is due to our consistency in realistically assessing and responsibly managing the macro economic risks, as well as those within our sector. Naturally, playing an important role in our success was Turkey’s own positive fiscal performance in 2007, where risks were likewise well managed and resulted in yet another year of economic growth.

Making matters more difficult, 2007 was a year of intensifying tension in the world economy due to the deteriorating risk perception in global credit markets. In Turkey, the events surrounding both the presidential and general elections brought a strain on the political situation.

In Turkey, the volatility in the domestic market was exacerbated by the ambiguity related to the presidential election, the forced postponement of which created a tension that carried over into the campaign period of the general elections. Notwithstanding, the effects of these negative conditions were cushioned by the strong performance of the Turkish economy, which was supported by the protection afforded via the high domestic real interest rates resulting in the further overvaluation of the Turkish Lira.

Clearly, the most important problem remaining for the Turkish economy is the high current account deficit, which stands at $ 38 billion in 2007. Interestingly, neither the deterioration in relations with the EU in view of the stalling accession process, nor the continuing problems concerning Cyprus and the terrorist activities in the southeastern region of the country have dampened the enthusiasm of financial markets for Turkish assets. Consequently, the FDI reached $ 19 billion.

Despite the slowdown in the global economy in 2007, the Turkish economy grew by 4.5% last year with an inflation rate of 8.4%, almost double the target set by the Turkish Central Bank. Total exports in 2007 rose to $ 107 billion and GDP per capita, according to the new calculation method, is projected at over $ 9,000. Industrial production rose by 5.4% while the unemployment rate manifested a slight increase of 10%.

Without a doubt, 2007 has been one of the best years in recent history for the Borusan Group. Our sales increased by 29% over 2006 totals, reaching the $ 3 billion threshold with a PBT (Profit Before Tax) level of $ 170 million. Our targets for 2008 are even more daring, as we aim for a 23% increase in turnover and profits in the highest investment year in our history.

The major factors influencing the Borusan Group’s operational results in 2007 were:

The world steel market in 2007 experienced a low price volatility compared with 2006. The market began with rising prices and then experienced a mild decrease before The world steel market in 2007 experienced a low price volatility compared with 2006. The market began with rising prices and then experienced a mild decrease before

picking up once again during the last quarter of 2007. Due to the continuing increase

of its production capacities over the past five years, China became the world’s largest

exporter of steel. The demand for steel remained high throughout the year, thereby

fueling the appetite for new investments and mergers.

The 10% growth in the domestic production of the export-focused automotive sector The 10% growth in the domestic production of the export-focused automotive sector

was quite remarkable, reaching 1,133,000 units. The home appliances sector also

experienced a positive growth of 5%, with a total production of 16.1 million units.

Despite the decline in the Turkish passenger car market to 357,465 units, manifesting an overall decrease of 4%, the total market share for the luxury and upper luxury sector grew by 25% in 2007, reaching 21,135 units. This up considerably over the 6% growth recorded in 2006. Despite the decline in the Turkish passenger car market to 357,465 units, manifesting an overall decrease of 4%, the total market share for the luxury and upper luxury sector grew by 25% in 2007, reaching 21,135 units. This up considerably over the 6% growth recorded in 2006.

The Euro/US $ exchange rate reached historically high levels in 2007 in favor of the The Euro/US $ exchange rate reached historically high levels in 2007 in favor of the

Euro, and the weakening US economy means there will most likely be further increases

in the same direction.

The overvalued Turkish Lira continued to be a threat to competitivenes in both the export and domestic markets. The overvalued Turkish Lira continued to be a threat to competitivenes in both the export and domestic markets.

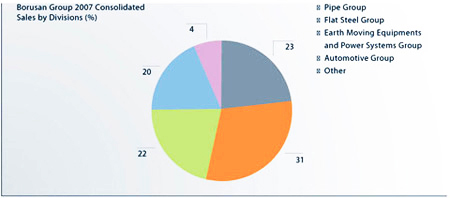

In 2007, the Borusan Group continued to grow both in terms of volume and revenue. Consolidated Group Sales rose to US $ 3 billion, reflecting a year-on-year growth rate of 29%.

The highest contribution to our consolidated revenue, 54%, came from our steel business, which processed 2 million tons of steel. Revenues from the Pipe Group in 2007 amounted to $ 695 million, while income from sales in the Flat Steel Group reached $ 911 million.

The distributorship businesses increased their share of the Group portfolio, contributing 41% of total sales. Meanwhile, although the domestic Caterpillar earth moving equipment business was negatively affected by the election period and the postponement of several major projects, it still managed a 20% increase in revenues. The increasing volume and margins in both Kazakhstan and the energy business resulted in a 27% increase in profitability compared to 2006. The Automotive Group enjoyed a substantial growth in the luxury car segment, thereby increasing its sales by 42% to $ 559 million.

Our logistics business continued to perform at a strong level, increasing its contribution to the Group by $ 30 million in 2007 compared to 2006.

|

International sales & export increased to US $ 663 million, maintaining a parallel growth pattern compared to 2006. The main contributors were the pipe, flat steel and earth moving equipments and power systems businesses of the Group.

Our Group preserved its gross margin level of 14% in 2007. While the steel margin was lower, the distributorship business succeeded in slightly improving its margin.

In 2007, we suffered from an overvalued TL/$ parity because of our TL-based operational cost base. Although our sales and general administrative costs increased and reached

$ 225 million in 2007, the Group realized a lower G&A/Sales ratio of 7.6% (as compared to 7.8% in 2006), thanks to its high sales growth rate.

Financial costs decreased in line with the decreasing libor rate; however, the overall financial expenses increased slightly, by 1%, reaching $ 36 million during the period of the highest investment level for the Borusan Group, coupled with the high growth in working capital requirements.

Consequently, in 2007 the Group realized a higher EBITDA of $ 245 million and profit before taxes of $ 170 million than the previous year, which was $ 227 million and $ 133 million, respectively.

Parallel with our growth in the business volume and high investment level, our total assets increased to $ 2 billion in 2007.

Borusan Group’s working capital increased by the end of 2007 to $ 904 million. Most of this increase is attributable to growth in the business volume, with only an extension of 6 days in working capital compared to 2006.

Our increasing business volumes, along with higher working capital requirements and investments, resulted in a higher net financial debt level of $ 393 million.

In 2007, our Group’s total capital expenditures reached a record of $ 159 million, the

highest level in the history of Borusan. These expenditures are part of the strategic

investments initiated in 2006, which will total $ 653 million between 2006 and 2010. Of

the investments in 2007, $ 67 million was utilized for capacity increases in flat steel and

pipe production, while $ 19 million went for rental fleet investments in the earth moving equipments and power systems and automotive businesses and $ 13 million was applied to an Energy license investment.

Having reached a current ratio of 1.2 and a net debt-to-equity ratio of 59%/41%, the Group’s 2007 balance sheet clearly reflects our business growth.

In summary, the Borusan Group achieved substantial growth in 2007. We are now headed towards another challenging year in 2008, projecting net sales of $ 3.6 billion, a 23% increase over 2007 figures, even though we have not budgeted for a financial crisis or a major slowdown in the Turkish economy. We are anticipating reaching a record high level of capital expenditure in 2008, amounting to $ 381 million.

The Group’s portfolio restructuring efforts in 2007 will pave the way for a divesture from the telecommunications business in early 2008 and a partnership between our Otomax business and Manheim, the world’s leading automobile auction and remarketing company. New and major key investments plans initiation for 2007 involved energy, a new line of business which started in August, and the decision in October to invest $ 500 million in a new hot strip mill with ArcelorMittal, the world steel giant.

As for the performance of our publicly listed companies, the total market capitalization of Borusan Mannesmann Boru and Borusan Yatırım, Borusan’s two representatives on the Istanbul Stock Exchange (ISE), reached a total of $ 344.06 million by the end of 2007.

Borusan Mannesmann Boru and Borusan Yatırım grew along with the ISE index during 2007 reaching a market capitalization of $ 249.44 million and $ 94.62 million, respectively. As of 2007 year end, the share of the foreign portion in the total free float was estimated at 16% in Borusan Yatırım and 26% in Borusan Mannesmann Boru.

Click for Divisional Analysis  |