General Overview

Despite going through two completely different cycles in 2008 Borusan managed to maintain a positive balance in its business results as a consequence of its realistic and responsible approach to management.

The first nine months of the year was undoubtedly the highest performance term in the history of the Borusan Group. The experience gained following the period of high and profitable growth, where the pace of our strategic investments gained momentum, was diverted to the management of our activities during the time of the major crisis that followed. It is important mention that, despite all the adversities that occurred during 2008, we managed to increase our sales by 15% to $ 3.4 billion, our investments to $ 302 million and still turned a profit of $ 175 million before taxes, interest and amortization.

The key factors that influenced the results of 2008 are as follows:

- After prices in the world steel markets reached their highest historical levels they plunged rather quickly, by about 66%, during the last quarter of the year.

- The fact that both the domestic and foreign markets were entrenched in an atmosphere of high uncertainty and volatility fueled by the worsening crisis, which initially started in the financial sector and quickly spread across the whole economy during the last three months of the year, led to an unanticipated amount of negative consequences in the sectors in which we are actively involved. Inevitably these conditions led to the cancellation of orders, a slowdown in production, a freeze or abandonment of investment projects, reduced financing opportunities and increased expenses.

- Across the country the primary sectors to which we cater, including the automotive, white goods and construction areas, experienced a 20 to 60% contraction in their business volume and there was a serious buildup in the inventories of the distribution channels and the main manufacturers. This caused adverse affects in production levels triggered by the drop in demand from these related sectors.

- In an environment where the macroeconomic balances have not been reached, preventive measures against the crisis have not yet yielded their desired effects. The approach to risk, performance criteria and judgments of value have all been brought.

- Despite all these dynamics, the attainment of a turnover of $ 3.4 billion and the maintenance of our 15% per annum average business growth rate that has been consistent since the start of the new millennium can be viewed as a positive development.

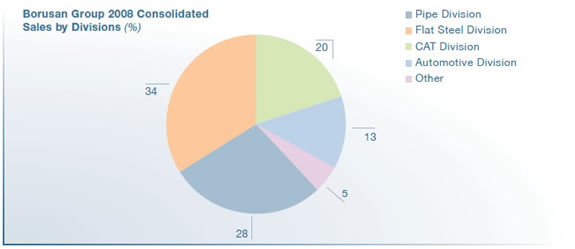

The largest contributor to the sales turnover of the Group was once again the Steel Group, which had a 62%, as compared to 54% in 2007, and an output of 1.8 million tons of milled steel. The turnovers of the Flat Steel Group and the Steel Pipe Division stood at $ 1.1 billion and $ 950 million, respectively.

The onset of the crisis coincided with the busiest months of the distributorship businesses and unavoidably caused a drop in their contribution to the turnover, which fell to a 33% share (41% the previous year). In response to the severe decrease in the domestic market the CAT Group managed to boost its contribution through its activities in other countries, thereby increasing its revenue to $ 697 million. With regard to the Turkish market, the distributorship activities of our BMW, MINI and Land Rover businesses certainly felt the stagnation of demand in the luxury automotive segment as the 2008 turnover contracted by 20% in relation to the preceding year and dropped to $ 446 million.

With respect to the dimensions of real growth our Logistics Division was without a doubt the most successful business enterprise, registering a 44% in earnings which was more than $ 250 million. Meanwhile, the revenue generated from the logistical services given to companies outside the Group increased to $ 136 million.

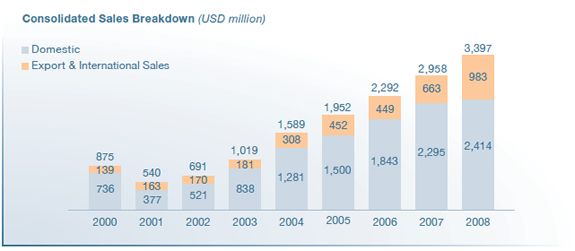

International sales and export dynamics in 2008 continued to outperform those of the domestic market. With regard to the growing trend of the Group and the offshore activities of our Pipe, Flat Steel and, in particular, CAT businesses, we have seen a major increase in our offshore revenues, which surpassed the $ 1 billion mark in 2008.

After experiencing a quite noticeable growth during the first nine months of 2008, sales profitability retreated to 11% in the last quarter of the year due to the negative effects of the crisis. This compares to a 14% growth rate in 2007. Although the average profitability of the Steel Group remained relatively stable when compared to the previous year, the margins of the distributorship business contracted to a certain degree.

Despite our growth and the ongoing investment projects, Borusan's efficiency and structural improvements gained significance during the crisis. Consequently, we were able to maintain the ratio of operational expenses to sales at the same level of 7.6%. In fact, due to the preventive measures implemented during the last quarter of the year, we improved the conditions for our efficiency in the following quarter.

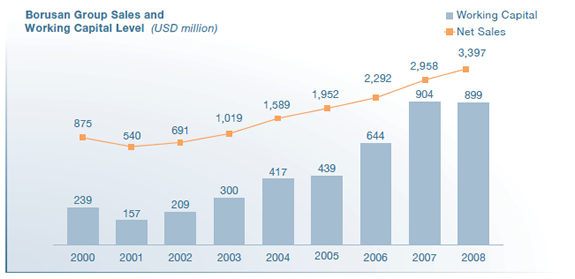

The contraction and liquidation policies implemented during the crisis contributed to a 15% growth in revenues. However, after growing rapidly throughout the year our operating capital volume remained at 2007 levels. In addition to measures taken concerning inventory management, our trade receivables/risk management has gained a greater importance.

In order to improve management efficiency during the crisis, supply chain structures were developed and processes pertaining of order-purchasing balances and demand estimations were also strengthened. At the start of 2009 the drop in the value of our inventories was fully compensated for and balances were adjusted according to appropriate market conditions. On the other hand, as risk management systems were supported by bringing on line such implementations as receivables insurance immediately prior to the start of the crisis, matters were certainly improved.

The $ 67 million provision set aside for the yearend drop in values of the inventories of the Steel Sector companies was perhaps the most important factor to affect the drop in profitability.

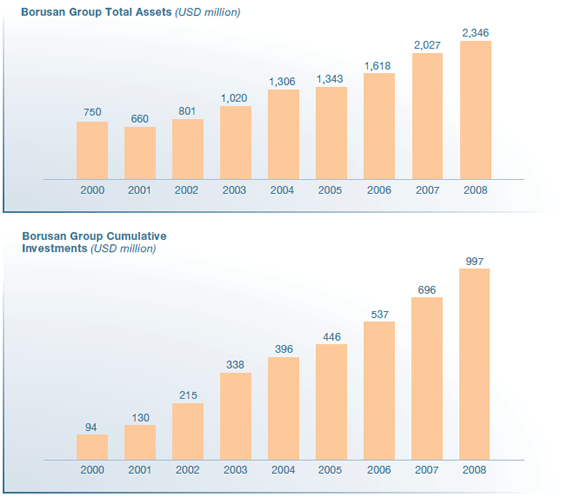

Fortunately, in the midst of all the volatility, we managed to carry on our activities without sacrificing our investment strategies and focus. The cumulative investment amount of the

Group since the beginning of the new millennium is slowly approaching $ 1 billion. Moreover, our annual investment sum of $ 301 million for 2008 was the highest figure ever in the Company's history. The emphasis was placed on projects possessing a strategic importance, including energy investments, port operations and expanding the production capabilities of galvanized steel. As the crisis began to set in, the investment needs of present business areas were evaluated, resulting in some postponements, cancellations or major revisions. The same focused and strategic approach is being implemented in 2009.

Investments that were made in the areas of flat steel, port operations and energy amounted to $ 84 million, $ 53 million and $ 93 million, respectively.

In light of these developments the Group's assets increased above the $ 2.3 billion mark, while the net borrowing level naturally increased. All investments were implemented after obtaining optimum net asset balancing and securing long-term investment financing. Thus, despite all the adverse effects, our operating capital and debt were substantially reduced while profitability was maintained. Furthermore, the transition to 2009 was made in the context of a thoroughly clear crisis management plan.